Features

By Sarah Whitebloom

Emotion and fear of COVID-19, rather than fundamentals, is fuelling stock market turbulence, according to Will Hutton, principal of Hertford College, Oxford and one of Britain’s leading political-economy commentators.

But, says Will Hutton, although the markets could be in for a ‘turbulent’ six months, the coronavirus outbreak could have much long-lasting impacts on the real economy, business and the financial world. In the immediate future he says: ‘The public health emergency is undoubtedly going to affect growth in the second and third quarters. There will be more sickening falls before the market reaction is over....There will be more lurches downwards.’

The best-selling author says there are significant potential impacts beyond the stock market: ‘We can’t just go back to the status quo ante after all this, particularly if there are significant numbers of deaths in the UK and beyond. It won’t be possible.’

I think the world will change, just as the debate has changed. Suddenly we have become aware...our lives have been affected. In the last three or four days, there has been a sudden realisation [that we are going to be personally affected]. And we have to pull together.

With little end in sight, Will Hutton says: ‘Markets are going to be turbulent over the next six months...The markets are panicking. There is a lot of emotion – and some of the losses may have malign cascade effects on the rest of the financial system, whose impact is hard to predict. But some shares are beginning to look cheap, if any type of normality returns, and there will be some benefits in this [for potential investors].’

However in the longer term, Will Hutton says: ‘I think the world will change, just as the debate has changed. Suddenly we have become aware...our lives have been affected. In the last three or four days, there has been a sudden realisation [that we are going to be personally affected]. And we have to pull together.’

Will Hutton says: ‘We need to emphasise the global public good, rather than pull up the drawbridge. It may work in the short term but it won’t save people.’

There needs to be a mind-set change. It’s no good an elite living virus-free behind locked gates, if the people who work for them are struck down by the virus....We need to get a grip on these things.

He says that ‘we need stronger global institutions for the global public good’; institutions such as the WHO and the World Bank. Only such institutions, he believes, can take on a crisis of international proportions, which is only heightened by a populist blame culture that has depicted the virus as a ‘foreign illness for short-term political gain’.

Will Hutton emphasises: ‘There needs to be a mind-set change. It’s no good an elite living virus-free behind locked gates, if the people who work for them are struck down by the virus....We need to get a grip on these things.’

For example, if there is to be safe international airline travel there will have to be some form of internationally validated system of testing of passengers – by the WHO – to ensure the plane is healthy. And to assure people in the destination country that incomers are not going to spread disease. So, while the crisis may inspire demand for more powerful supra-national institutions, Will Hutton maintains, it will also make businesses think again about ‘free-wheeling globalisation’.

One of the long term impacts could be on the way companies organise themselves, so they are not so globally dependent.

He says: ‘One of the long term impacts could be on the way companies organise themselves, so they are not so globally dependent.’

According to Will Hutton, COVID-19 has exposed the dangers of economic populism, globalisation and isolationism. He also says: ‘One key lesson is that health is not only about having the best drugs or clever surgeons, it’s also about the collective good....America going into this pandemic with 27 million people who do not have insurance and millions more in the gig economy. An economic structure like this makes them vulnerable.’

He believes the impact of the crisis will force change at ballot boxes around the world for politicians who have been exposed and found wanting: ‘Some politicians [those who have not taken adequate measures] are going to pay a heavy price for this.’

He adds: ‘We have learned it is essential to direct resources to the hot spots and work together – at home and internationally. The virus doesn’t respect borders of any sort....It has emphasised our inter-dependency.’

Amid the bleak concern, however, Will Hutton has warm words for last week’s Budget from the Chancellor, Rishi Sunak: ‘The state is back, Keynes is back, government taking responsibility is back.'

By Sarah Whitebloom

From Darwin to the present day, creating a monograph is at the heart of biological science. It takes years of painstaking effort and attention to detail to describe and log each and every species in a genus, producing an encyclopaedic guide – the monograph. It is taxonomy at its most taxing.

Large-scale monography is rarely undertaken today and is often seen as passé, dusty even, despite its undoubted value. Nevertheless, a team led by Professor Robert Scotland, of Oxford’s Department of Plant Sciences, has revived this time-honoured art by creating a landmark monograph of the genus Ipomoea. Better known as ‘Morning Glories’, the genus includes more than 800 different species, including the crop, sweet potato. And it is anything but dusty, blending traditional techniques with cutting-edge science to produce a massive monograph of 825 pages.

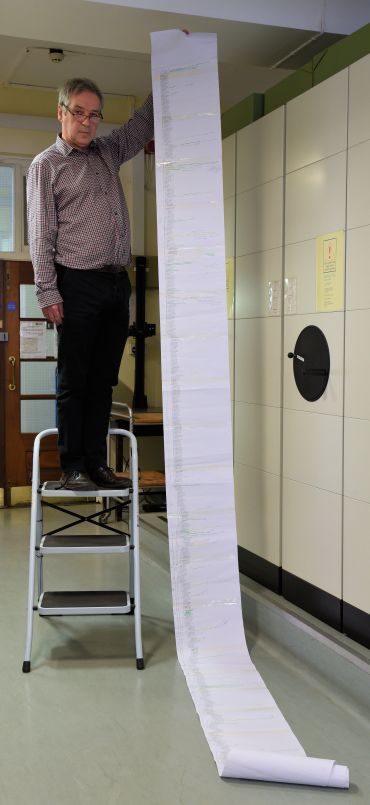

Professor Robert Scotland holding the Ipomoea family tree

Professor Robert Scotland holding the Ipomoea family treeAs part of the work, the team needed to identify specimens from around the world. Carrying out such a massive piece of research has taken the team of four more than five years, examining thousands of specimens from 80 different collections in Europe as well as from around the world.

The team has discovered 65 new species and have corrected numerous errors in the labelling of plant specimens in museum collections.

To date, the team has discovered 65 new species and have corrected numerous errors in the labelling of plant specimens in museum collections. They have challenged some long-held ideas cherished by botanists and anthropologists. They have created quite a stir in the South Pacific, because the monograph established that plants had travelled long distances over land and sea, without any human assistance – undermining assertions that the existence of sweet potatoes in Polynesia proved beyond doubt there must have been early contact between the Americas and islanders.

Why does this matter? Aside from the obvious academic uses of the monograph, John Wood, one of the monographs authors, says it has very real implications for the environment and for conservation.

How can you know the future of a plant, if you don’t know of its existence or its characteristics?

‘How can you know the future of a plant, if you don’t know of its existence or its characteristics?’ he asks. This is particularly important in the case of potential food crops, such as the wild relatives of the sweet potato, which is one of the top ten global food crops.

‘Insects and flowering plants are the two big powerhouses of global biodiversity,’ says another of the authors, Dr Pablo Munoz Rodriquez . ‘Yet for groups, such as Ipomoea, we haven’t even known what there is….and there’s no chance you can conserve something, if you don’t know what you’ve got.’

By Sarah Whitebloom

Market hysteria over coronavirus may have seen hundreds of points wiped off indexes around the world this week, but Oxford University experts maintain the COVID-19 crisis should not necessarily foreshadow an economic downturn.

Professor Simon Wren-Lewis, economist and expert in the impact of pandemics at the University of Oxford, maintains that modelling he undertook after the 2008 global financial crisis, shows the coronavirus crisis should have a short-term impact and need not have a long-lasting effect on the UK economy. This view was echoed by Rishi Sunak, the new Chancellor of the Exchequer, during this week’s Budget speech [11 March], when he said the impact of the coronavirus will be ‘temporary’.

Professor Wren-Lewis says: ‘Ever since the global financial crisis (and perhaps before) we have become obsessed with markets and, in particular, their imagined predictive power.’

He added: ‘Looking at the markets, it appears the economic impact of coronavirus will be huge and permanent. In contrast my own study, and others we refer to, suggest something very different: that coronavirus will lead to a large negative shock that will be short term, and certainly will not be permanent. So who is right?’

Based on a three-month virus crisis, Professor Wren-Lewis said his modelling study showed, there is a danger of firms going bust, as we have already seen in the airline sector. But, this week, the banks have said they will support hard-hit businesses and the 2009 study showed that, once the virus is over, firms will become viable again.

It has been widely claimed firms will be vulnerable if they lose production, as workers fall ill or have to take on child care duties because schools are shut. In a blog this week, Professor Wren-Lewis says unwell workers may lead to falls in production but that: ‘Firms have ways of compensating for this…This ‘direct’ impact “[from the effect on the workforce]” of the pandemic in the UK, will reduce GDP in that quarter by a few percentage points.’

His blog says: ‘The impact on GDP for the whole year following the pandemic is much less at around one or two per cent, partly because output after the pandemic quarter is higher as firms replenish diminished stocks and meet postponed demand.’

He continues: ‘Even with all schools closed for three months and many people avoiding work when they are not sick, the largest impact we got [based on the study’s findings] for GDP loss over a year was less than five per cent. That is a very severe one-quarter recession, but there is no reason why the economy cannot bounce back to full strength once the pandemic is over.’

This could still mean that there are short-term problems of supply, with supermarkets unable to keep their shelves stocked with everything. But a decline in demand, caused by people self-isolating and not consuming, could have a more significant impact.

With consumers changing behaviour and avoiding social spending on restaurants, pub visits or entertainment, the leisure industry could be hit hard. These will not be made up after the crisis has passed, with consumers unlikely to eat multiple meals out, in order to compensate for those not eaten during any period of isolation. As part of the Budget, the Chancellor announced special measures to alleviate the impact on the leisure industry, with business rates being lifted and support for the sector.

Professor Wren-Lewis says: ‘If people start worrying about getting the disease sufficiently to cut back on this social consumption, the economic impact will be more severe than any numbers discussed so far. One reason it is severe is that it is partly a permanent loss.’

Nevertheless, according to the economic modelling, the largest fall in annual GDP was six per cent. ‘It is in this light that we should view the collapse of stock markets around the world. In macroeconomic terms this is a one-off shock,’ according to Professor Wren-Lewis.

He adds: ‘Markets dislike uncertainty, and so you are likely to see an overreaction.’ But, he says, this should not be allowed to distract policymakers from following the best medical advice.

Some of the measures Professor Wren-Lewis said would alleviate the situation for the economy have been taken, ’although more could be done to encourage low paid or self-employed workers to self-isolate’.

Banks have extended lending and given mortgage-holidays to customers in need. Chancellor Sunak maintains that he will be having regular meetings with the banks. And the Budget contains a series of measures, aimed at protecting businesses and individuals from the potential economic impact of the coronavirus.

Read more on Professor Wren-Lewis’s blog: https://mainlymacro.blogspot.com/2020/03/the-economic-effects-of-pandemic.html

Funding for Oxford’s COVID-19 research requires unprecedented speed, scope and ambition. Find out how you can support us here.

By Sarah Whitebloom

Markets have this week headed south and then north again, as investment centres around the world respond nervously to the coronavirus outbreak, but a leading Oxford finance expert maintains the impact of the virus on the overall economy and the markets is not likely to be long-lasting.

Bige Kahraman Alper, Associate Professor of Finance at Oxford’s Saïd Business School says: ‘There has been a huge market reaction…there is both a negative supply and a negative demand shock.’

But, Professor Kahraman Alper maintains, the situation looks very different from the global financial crisis of 2008. Share prices tumbled. The FTSE 100 index fell some 20 per cent in just eight days – from 6,815 on 4 March to 5,459 on the 12th. But on the 13th, the index staged a recovery of more than six per cent in opening trades.

According to Professor Kahraman Alper, there are genuine issues relating to fundamentals, for several companies earnings’ forecasts are revised downwards for the forthcoming quarters, but many of the supply and demand problems are likely to recover and some are simply related to market sentiment.

Professor Kahraman Alper says, for a subset of companies, though, it is possible to observe long-lasting effects. Companies, which may have poor financial profiles or which are in particularly hard-hit sectors, may be vulnerable and potentially some could become insolvent. She says: ‘There will be demand bounce-back and overall businesses are most likely to recover from the demand and supply shock.’ But, she says ‘not all’ will do so.

Concerns over corporate insolvencies are clearly having an impact on the markets – although it would mainly be smaller enterprises affected. But Prof Kahraman Alper says: ‘Financially constrained and struggling businesses, even if they are not quoted, are bad for the overall market.’

Other than falling indexes, the current crisis bears little similarity to the market crash of 12 years’ ago. Prof Kahraman Alper points out that this time problems did not start in the financial sector, which was strengthened following the global financial crisis.

But, she says, if the markets continue to tumble, there could be genuine knock-on effects for the asset management industry. Banks may not be as vulnerable as they once were, but in theory, if the current trends market continue, there could be runs on funds under management.

‘If market prices go down, we may see runs on hedge funds and asset managers,’ says Professor Kahraman Alper.

But, she maintains, the authorities, such as the Bank of England, have been closely watching developments – to make sure this does not turn into a full-blown financial crisis.

‘They would try to do what it takes around a scenario where there is a run,’ she adds.

And the current situation is very far from such scenarios. The Chancellor announced in the Budget a package of measures aimed at supporting individuals and business and there are a number of tools in the financial watchdogs’ toolkits. On Wednesday, the Bank of England cut interest rates.

But rates cannot go down much further, without going negative. If it were necessary, the authorities could inject capital. But, says Professor Kahraman Alper: ‘It all depends on what actions are taken today….The things we do now will determine the long-term consequences on the market.’

Encouraging everyone to follow a long-term and contrarian investment strategy, a strategy that historically delivers high investment returns, the professor suggests that, if each person were to invest, say, $10 in the market, it would be good for their finances - and help the markets.

‘The recovery is an opportunity,’ she says. ‘It’s a good time to invest – and it would help the markets to recover faster.’

Oxford scientists have discovered a key underlying cause of a range of serious conditions including cancers and Motor Neurone Disease (MND). It's important because if you know why something happens, you can try to do something about it and you are a lot closer to fixing it. So it was overwhelming when Professor Kristijan Ramadan and his team at Oxford's Department of Oncology discovered that a naturally-occurring, but faulty, ‘protein plough’ is linked to a range of very serious conditions.

Professor Ramadan explains that, if the body is working properly, proteins swoop in to repair lesions or damage to the DNA. Lesions can occur because of drinking, smoking, during illness or because of medicines.

Professor Ramadan’s work gives hope that it will be possible to identify patients for whom the usual treatment is not going to work – enabling them to be given an alternative without waiting.

‘They occur all the time – and can be caused just through breathing Oxygen,’ says Professor Ramadan. But, what his team discovered is that a protein called Topoisomerase 1, which comes in to repair damage to the DNA, can become toxic, if it sticks, in a covalent attachment, to the DNA.

In simple terms, he says, the body has its own little ‘protein plough’ which should remove proteins before they become a problem. In more complex terms, specialised DNA repair machinery composed of the p97 ATPase, 'protein plough' SPRTN protease and an autophagy receptor TEX264, should tackle the linked protein-DNA toxic product.

Although an essential part of the body’s repair system, the protein must be transitory only. According to Professor Ramadan, if it remains on the surface of the DNA for too long, it can become entangled, difficult to remove, and potentially toxic. Problems arise, he says, if the body’s natural plough does not clear away the protein – or if it clears away proteins too rapidly, before they have a chance to repair the lesion.

The implications are potentially immense. Pathological accumulation of the protein, also known as Topoisomerase 1-cleavage complexes, is linked both to neurodegeneration and cancer. Faulty ‘protein ploughs’ can cause or undermine treatment for cancers and lead to debilitating conditions such as Motor Neurone Disease, and even to premature ageing.

In the case of some cancers, Professor Ramadan says, a super-functional ‘protein plough’ can undermine chemotherapy treatment, by clearing it away from the DNA before it can be effective. Chemotherapy prevents cancer cells replicating. If it is cleared away, by an over-zealous plough, the cancer treatment will be ineffective and there is much greater possibility of metastases. In the early days of treatment, critical months can be lost on failed treatments and by then, the cancer can already have spread. Professor Ramadan’s work gives hope that it will be possible to identify patients for whom the usual treatment is not going to work – enabling them to be given an alternative without waiting. And it offers the possibility of identifying people prone to particular conditions, before they become ill, allowing potentially preventative treatment.

In terms of MND and early-onset hepatocellular carcinoma, according to Professor Ramadan, in some cases these conditions are caused by an under-active ‘plough’ repair system, which could be recognised by targeted DNA testing. If a ‘protein plough’ fails to clear away the protein, which then sticks to the DNA, it can become very difficult to remove – potentially leading to cancer and MND.

Now that this key factor has been identified, it offers the possibility of inhibitors being developed, which will prevent an over-active plough clearing away life-saving treatment. And it holds out the prospect for an under-active plough, to be repaired. The discovery has caused considerable consternation in the scientific community, because the work has implications for so many serious conditions.

Professor Ramadan's team was approached by the doctors of a 13-year old child, who was ageing prematurely, aware that the team was working in this area. At the lab in Oxford, they were able to ascertain that the patient’s condition was caused in this way.

Professor Ramadan's team was approached by the doctors of a 13-year old child, who was ageing prematurely, aware that the team was working in this area. At the lab in Oxford, they were able to ascertain that the patient’s condition was caused in this way. This work was done a few years back. Now, the team has discovered TEX264 protein, an additional component of the specialised DNA repair mechanism for the removal of toxic DNA-protein complexes. TEX264 specifically governs the plough protein (SPRTN) to toxic DNA-protein lesions known as Topoisomerase 1-cleavage complexes. In this way, TEX264 and SPRTN (plough) work in concern to prevent genomic instability that could be associated with some types of cancer or NMD.

Awareness of the problem is one thing, using the knowledge to treat patients is another. Although it is possible to test for a fault with the body’s mechanism, identifying potential problems before they happen, it will be some time before inhibitors can be developed and become part of treatment. A considerable injection of funds, running into tens of millions of pounds, will be needed before treatments to repair faulty ploughs or overcome the issue are patient-ready.

- ‹ previous

- 46 of 252

- next ›

10 years on: The Oxford learning centre making an impact

10 years on: The Oxford learning centre making an impact Oxford and The Brilliant Club: inspiring the next generation of scholars

Oxford and The Brilliant Club: inspiring the next generation of scholars New course launched for the next generation of creative translators

New course launched for the next generation of creative translators The art of translation – raising the profile of languages in schools

The art of translation – raising the profile of languages in schools  Tracking resistance: Mapping the spread of drug-resistant malaria

Tracking resistance: Mapping the spread of drug-resistant malaria Cities for cycling: what is needed beyond good will and cycle paths?

Cities for cycling: what is needed beyond good will and cycle paths?