$5 trillion of nature-related economic risks will amplify climate change, says Oxford study

- “Nature is not the elephant in the room, it’s the huge green scorpion running towards us”- study author.

- Biodiversity loss and environmental degradation generates significant and long-term risks to society, the economy and finance…and risks to global supply chains.

- Potentially catastrophic impacts of climate change and the critical importance of integrating climate and nature in our response to these threats.

Shocks to the global economy related to biodiversity loss and ecosystem damage could cost upwards of $5 trillion, according to new research from Oxford University, which emerged alongside recommendations from central banks in respect of assessing nature-related risk.

The researchers found, human-driven pollution, deforestation, land-use change and over-extraction, are fundamentally eroding the natural capital upon which our societies and economies are built – including our water, clean air, fertile soils and pollinators – and act as ‘risk amplifiers’ on the impacts of climate change.

The ECI study concludes, the erosion of natural capital linked with biodiversity loss and environmental degradation generates significant and long-term risks to society

The Network of Central Banks and Supervisors for Greening the Financial System (NGFS) – the network of over 120 Central Banks and supervisors globally – made its recommendations in respect of assessing nature-related economic and financial risks.

As part of this work, Oxford’s Environmental Change Institute studied the development of scenarios for climate-nature shocks and gathered the evidence on the macro-criticality of nature for the global financial system. The analysis focused on three risks: water, pollution and pollination.

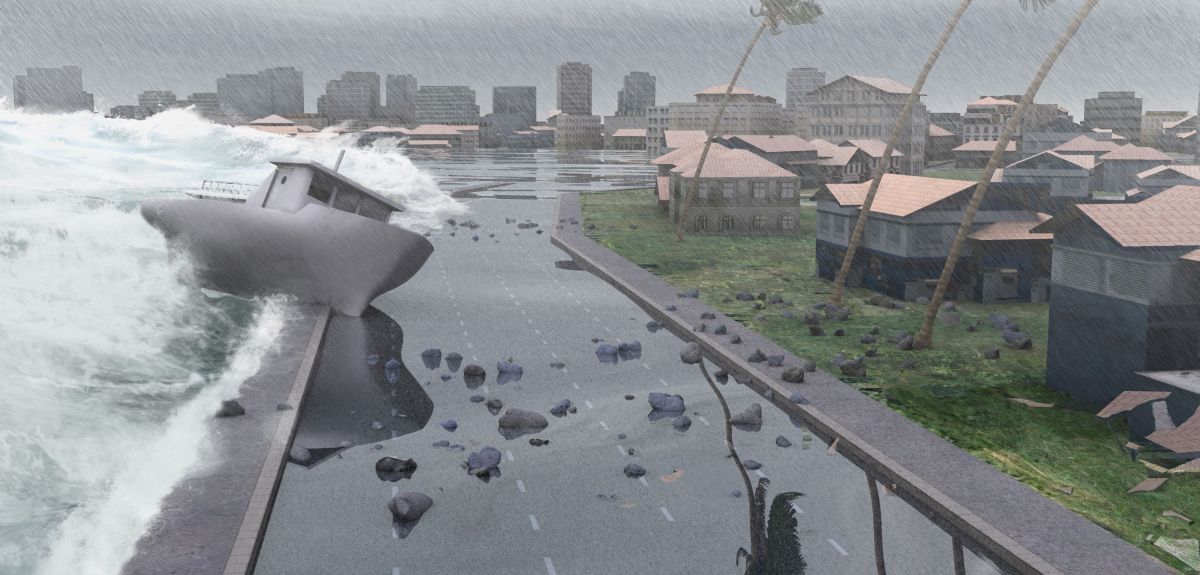

The ECI study concludes, the erosion of natural capital linked with biodiversity loss and environmental degradation generates significant and long-term risks to society, the economy and finance, from increased risk of pandemics, floods and droughts.

Dr Nicola Ranger, who led the study and is Director of the ECI's Resilient Planet Finance Lab, said, ‘Protecting and restoring nature is essential for the functioning of our economies and a vital component of adaptation to climate change.’

Nature is not the elephant in the room, it’s the huge green scorpion running towards us. The sting in its tail will significantly amplify the impacts of climate change in ways that are difficult to predict

Dr Nicola Ranger

Reflecting on the negotiations at COP28, she explains, ‘Nature is not the elephant in the room, it’s the huge green scorpion running towards us. The sting in its tail will significantly amplify the impacts of climate change in ways that are difficult to predict. It is not just about birds and butterflies, we are fundamentally eroding the natural capital upon which our societies and economies are built.’

Professor Michael Obersteiner, Director of the ECI, added, ‘This study provides an inflection point towards macro-resilience by visualising and credibly articulating the forward-looking dynamic risks associated with the erosion of natural capital. Our methodology will empower the finance sector to deliver Planetary health.’

Global food systems are revealed to be at particularly significant risk as a result of soil erosion, land-use change and loss of pollinators, aggravating the impacts of climate change. Global supply chains are shown to be a significant risk from water scarcity and pollution.

This study provides an inflection point towards macro-resilience by visualising and credibly articulating the forward-looking dynamic risks associated with the erosion of natural capital

Professor Michael Obersteiner

The study also highlights the challenges for financial institutions in managing these risks that are currently not fully accounted for within the financial system. For governments and regulators it recommends a precautionary approach, including an urgent need to identify and assess risks, in line with the recent recommendations of the Taskforce on Nature-Related Financial Disclosures, and identify potential gaps in regulation.

Landmark study definitively shows that conservation actions are effective at halting and reversing biodiversity loss

Landmark study definitively shows that conservation actions are effective at halting and reversing biodiversity loss

Researchers find oldest undisputed evidence of Earth’s magnetic field

Researchers find oldest undisputed evidence of Earth’s magnetic field

Honorary degree recipients for 2024 announced

Honorary degree recipients for 2024 announced

Vice-Chancellor's innovative cross-curricular programme celebrated

Vice-Chancellor's innovative cross-curricular programme celebrated

New database sheds light on violence in Greek detention facilities

New database sheds light on violence in Greek detention facilities